| SumUp AirOur Rating: 4.5 /5

| |

CARD READER PRICE £29 | TRANSACTION FEE 1,69% | MONTHLY COST £0 |

| SumUp 3G + Printer | |

CARD READER PRICE £149 | TRANSACTION FEE 1,69% | MONTHLY COST £0 |

Full SumUp Review

All you need to know about one of the biggest mPOS companies in Europe – SumUp. Check out the cost & fees structure, security and, the technology behind the card reader and much more…

SumUp Air vs. SumUp 3G

The business has never been easier for young entrepreneurs and small business owners, with so many useful and handy gadgets on the market.

One of these tremendous innovations is a mobile card reader from SumUp, proving to be a reliable solution at an affordable price.

Let’s face it…

The world has gone digital and most businesses run on e-commerce, having cash at hand in today’s society has become outmoded. In such times, devices such as SumUp Air or SumUp 3G can make your life easier and more manageable.

With an economical flat rate at 1.69%, both mobile card reader presents you a preset rate without the hassle of additional costs.

Now.

The SumUp Air and SumUp 3G may not be different in their outward make but their operation depicts their differences. The table below shows the major differences between the two card readers:

**(advanced mode)

SumUp Air review

For most businesses, the job is as good as done once payments have been made successfully.

That said, transactions get easier when traders are equipped with handy payment gadgets. One of these gadgets is SumUp Air, an mPOS reader that is a tremendous innovation in the business world.

Let’s dive right in…

SumUp Air – Pros & Cons

![]() Pros:

Pros:

- Affordable credit card machine, ideal for low-volume merchants

- Supports integration with POS systems

- Connects to external printers / allow to print receipts

- Reliable battery life – up to 500 transactions

![]() Cons:

Cons:

- SumUp app covers only the basic functionalities. Users needing a feature-rich point of sale (POS) system will most likely struggle with the limitations

- The phone support is available only on Monday – Friday (9 am – 6 pm) and Saturday (9 am – 6 pm), which may be problematic for businesses operating mainly over the weekend like bars and restaurants

SumUp Air Review – Summary:

SumUp Air is an easy to use, pocket-size mobile card reader (current price: £29) that comes with no monthly fees or contract (just 1,69% transaction fee). It connects to external printers (so you can print receipts) and supports integration with POS systems.

The downside: limited app features, no phone support on Sunday.

Payment with SumUp Air

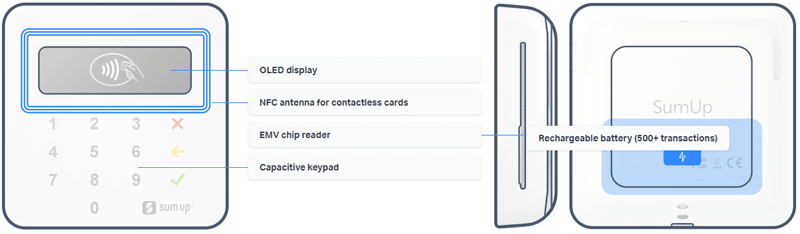

What is a SumUp card reader?

It’s a compact and low-cost reader that works hand in hand with a mobile app for operation.

It is charged via USB and supports a couple of card-reading modes. It has a chip & PIN reader, a contactless receiver, but no magnetic stripe reader.

The reader is connected to a smartphone or tablet via Bluetooth. Furthermore, the reader can support two Bluetooth speakers and a few more network printers.

What else?

SumUp Air supports all the major credit and debit cards including:

- Visa

- V Pay

- Visa Electron

- Maestro

- Mastercard

- American Express

Not bad.

SumUp – accepted cards

SumUp Air – prominent features

There you have it:

1. Long-lasting battery

With a long-lasting battery life (up to 500 transactions), SumUp is very easy to carry on tours and travels.

2. Chargeable with Micro USB

It is easily chargeable with the Micro USB cable included in the package. Even while charging, you can use the card machine.

3. Pocket size

It is a great travel gadget with a size of 7cm x 7cm x 2.5cm hence can easily fit into most briefcases or bags and does not increase luggage weight substantially.

It can easily be used whenever required and stored away when not needed.

4. Easy and reliable transactions

It is compatible with most credit and debit cards (Visa, VPay, MasterCard, Maestro or American Express) and can easily be used when making transactions.

Moreover, the card terminal comes without any monthly costs or contracts that could hinder your progress. The payment is guaranteed and reliable.

Bottom Line:

The SumUp Air is a great portable device that business owners can take with them wherever they need to accept payments.

It’s extended battery life and ease-of-use means that virtually anybody can process payments anytime they require.

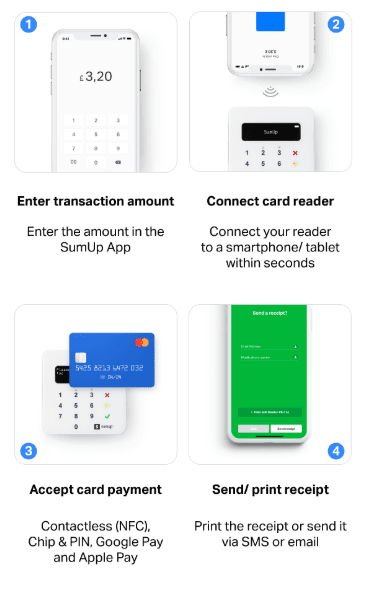

How to get started with SumUp Air

So, how to set up your SumUp Air card reader?

In order to receive the card reader, you have to register online, which is fairly simple. The card reader is delivered by post within a week and you can start using it right away.

All the instructions that are required for setup are available on the box and also when the SumUp application is downloaded.

The set up is relatively simple.

Here’s how…

After downloading the app (which is free for Android and iOS), you connect the device and allow one pound into the app.

After initiating the charge the setup begins by design.

However, if the instructions are vague on the box, then there are online guidelines that can help you set up the device more accurately.

How does SumUp work?

In order to accept cards, you will need a smartphone or tablet.

You need to get the SumUp Air reader activated in Bluetooth mode and then remotely connect the app.

All you need after that is an internet connection or good WiFi and you are good to go.

The wireless SumUp Air connects through the cloud-based server, analyzes, and proceeds with your transactions.

SumUp Air – how it works, image source: https://help.sumup.com

SumUp supports various receipt printers that you can use when accepting payments with Air card reader.

The portable printers connect via Bluetooth to your device so you can take them with you wherever you go.

Portable printers supported by SumUp Air:

- Mobile Bluetooth Printer Bixolon SPP-R200lliK/BEGE

- Mobile Bluetooth Printer Bixolon SPP-R210iK/BEGE

- Mobile Bluetooth Printer Star Micronics SM-L200

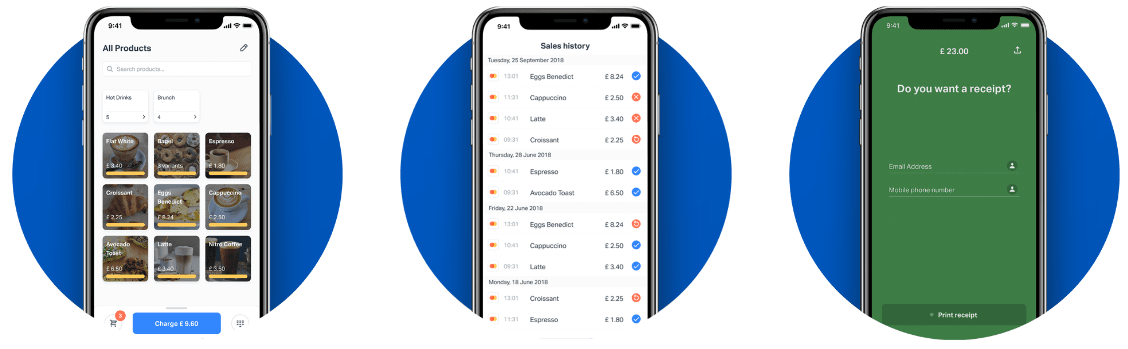

SumUp App

The SumUp app is available to download for free for either the Android or iOS platforms and takes very little time or effort to set up.

Simple.

Keep in mind, that SumUp app will only work on the devices with:

- Bluetooth 4.0 to connect wirelessly with the reader

- Apple/iOS devices: operating system iOS 7.0 or higher

- Android devices: operating system Android 4.4 or higher

Using the app is very intuitive. Whether this is your first time using a mobile card reader or you’ve dabbled in them all you should be able to find your way about fairly easily, at least for the basic functions.

Once you have downloaded the app and created your account, you can begin to add your “new products” into the store.

Adding a new product is simple, as a screen opens where you can upload a picture, add a product name, description and set the tax rate for each item.

You can also add a variety of versions for each product, such as the size, colour or any other identifying information.

Once you have products in the app, you can create “Shelves”, which are essentially different categories for your products.

This keeps your inventory well organized and is very beneficial if you are working in a busy environment so that you can easily navigate to find items.

SumUp app

Now.

Let’s have a look at all the features available in the SumUp app:

- Item Library

- Item Variants

- Refunds

- Tips*

- Multiple Tax Rates

- Quick Sale Mode

- No Signature For Transactions < £25

- Cash Recording

- Email And SMS Receipts

- Basic analytics

*You’ll have to contact SumUp to enable this feature

With SumUp Air you can also print, email or text the receipts to the purchaser after each transaction.

Very cool.

After the transaction is completed, the receipt option will pop up and you can select the method of your choice.

Although, the list of features in the SumUp app is long, there are some key functionalities that seem to be missing. Here are some examples:

- Bulk product import/export

- Invoicing

- Discounts

- Inventory counts

To be clear:

There are some downsides, but overall SumUp’s app is an efficient tool for accepting card payments.

Bottom Line:

SumUp offers vendors a wide variety of services to help them sell their products, manage inventory and view past transactions.

By making it so simple to add and organize products, businesses can have their entire product line uploaded into SumUp and ready for sale within a day

SumUp 3G review

New SumUp 3G card reader is crafted for merchants who prefer a standalone device for accepting contactless and card payments.

How’s that?

It does not require a mobile phone or tablet, as it utilizes the unlimited data included in the device to establish a network connection to process payments.

This makes 3G to be a perfect solution for merchants who don’t need complex POS functionalities but instead prefer fast and easy to use the portable device.

The upfront cost of getting a 3G card machine is £149 + VAT. As with SumUp Air, the transaction fee is 1.69% and there are no other ongoing costs or fixed monthly fees.

But wait – there’s more…

SumUp 3G – key information:

- Costs: £149 for the card reader (free delivery) + 1.69% transaction fee

- Printer included

- Connects automatically to the 3G network via the built-in SIM card

- No data costs. No WiFi nor smartphone needed

- Supports both contact (chip and PIN) and contactless payments

- Only supports text and email receipts; printing a paper receipt is unfortunately not possible

- Battery life can support up to 50 transactions

SumUp 3G Review – Summary:

SumUp 3G is an easy to use, standalone card reader (with built-in SIM card and unlimited mobile data), extremely useful for merchants accepting transactions on the go.

Flat transaction fee (1,69% per transaction) and no monthly fees making it perfect for small businesses with low sales volume. The downside: low battery life (only 50 transactions).

New offer – SumUp 3G and printer bundle

At the beginning of 2020, Sumup launched a new offer. Now their new SumUp 3G card reader can be purchased together with a printer at a special price £149 + VAT. The printer nicely adapts to the shape of the reader and at the same time works as a charging station.

Let’s face it, paying £49 extra for a printer still seems like a pretty high price. However, if you print a lot of receipts and you like fast and simple solutions, this offer will be worth it.

| SumUp 3G + Printer

| |

CARD READER + PRINTER £149 | TRANSACTION FEE 1,69% | MONTHLY COST £0 |

SumUp 3G – Pros & Cons

![]()

Pros:

- Standalone device – no mobile phone/tablet required

- No data costs. No WiFi nor smartphone needed

- No fixed costs or monthly fees

![]() Cons:

Cons:

- Limited features

- Cannot print paper receipts

- Doesn’t support integration with POS systems

SumUp 3G – how to get started

Let’s jump right in…

To start accepting card payments using SumUp 3G, you must first set it up. Luckily, the process seems to be quick and easy.

How do I set up SumUp 3G?

STEP 1

Complete your SumUp account registration. This involves logging in to the SumUp website and registering your SumUp account. This is necessary for you to start receiving payments.

STEP 2

Turn on the card reader (by pressing the power button) and select your preferred language for your device.

STEP 3

Establish a cellular network connection and enter the email and password for your SumUp account.

STEP 4

Now the reader will take you to a screen where you can enter an amount for the payment (minimum £1.00). Press the green tick to confirm the transaction.

That’s it! You are ready to receive your first payment.

Accepting Card Payments with SumUp 3G

Here’s all you have to do:

After setting up your SumUp 3G card reader, you can begin accepting card payments.

To do so, just follow the instructions below:

1. Make sure the reader is turned ON and that you have logged in with your account credentials.

2. Enter the payment amount and press the green button. The customer can pay by:

– tapping their cards (NFC-enabled) on the reader’s screen

– inserting their cards at the bottom of the card reader for the chip to read

– swiping a magstripe card at the bottom of the card reader

3. Whenever prompted, the customer should enter their PIN or sign the screen before pressing the green tick or button.

Then you will see the notification “Send Receipt”. You can select a receipt option “SMS receipt”, “Email receipt” or “No receipt”. Depending on the preference, request the customer to enter their mobile number or email address.

And you’re set.

Technology and Hardware

The SumUp 3G card reader depicts several physical and technological differences from its predecessor SumUp Air. For example, it gives you the option of receiving the latest device updates on your device to maintain its efficiency.

In addition to that, SumUp 3G accepts all major debit/credit cards like Visa, V Pay, Mastercard, Maestro, and American Express as well as Apple Pay and Google Pay.

Sounds good, right?

Let’s dig a little deeper. The main tech and hardware properties of this card reader are summarized in the table below. Take a look:

SumUp – Frequently Asked Questions

SumUp costs & fees

How much does SumUp charge per transaction?

Both devices offer a very fluid and see-through transaction with a rate of 1.69% on all payments, which is currently the lowest on the market in the UK.

An additional £29 (SumUp Air) or £149 (SumUp 3G) has to be paid for the mobile card reader as a one-time fee. Like its competitors iZettle and Square, SumUp does not have any ongoing or monthly fees.

On top of that, the delivery of the card reader is free, with a 30-day money-back guarantee if you decide to return the device. You receive one year warranty if you decide to keep the reader.

All in all, the main things to consider are:

Can SumUp take phone payments?

Yes. You’ll be glad to know that SumUp offers also the option to take phone payments (without a mandatory monthly charge). However, you’ll need to contact first the customer support to enable this feature.

Payments using virtual terminal are charged at 2.95% + 25p.

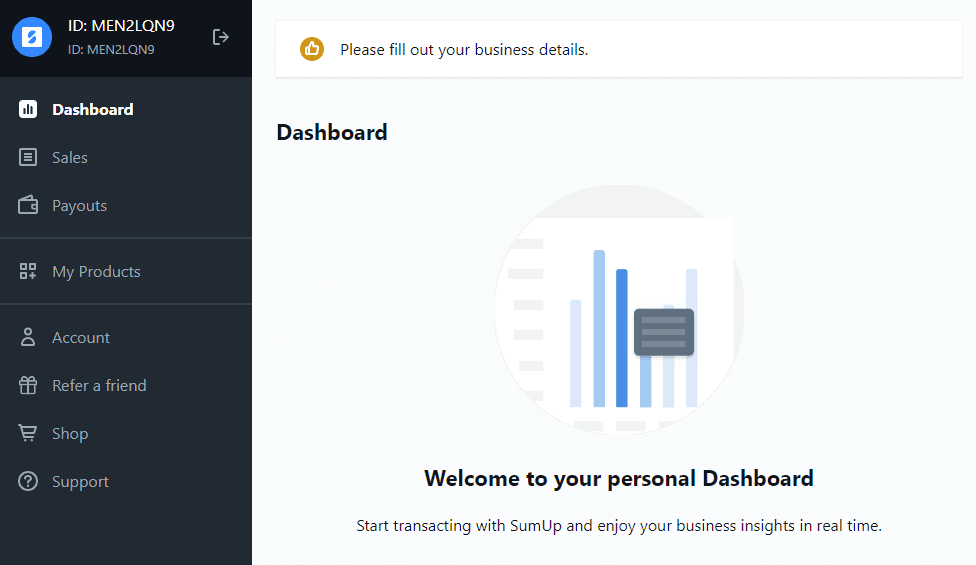

SumUp dashboard

How long do SumUp payments take?

SumUp delivers the funds to your bank account in 2-3 business days. This is the pretty standard timeframe for any kind of card processing company.

How do you get a refund from SumUp?

You can issue full refunds on transactions made with both card readers in your dashboard at sumup.me.

If the refund was requested right after the transaction took place, there will be no charge for that. However, if payments already arrived at your bank account, SumUp will charge a £10 admin fee for the refund transaction.

And one more thing:

In compliance with the company’s cash reserve policy, some portions of payments can be withheld to prevent fraudulent activity. This policy is not a major cause of concern and the upside is that there is absolutely no termination fee and no PCI compliance fee.

SumUp customer service

Often customers have a lot of questions that need answering and good customer service is one that gives a timely and comprehensive response.

In general, SumUp has a reliable customer service that interacts with merchants to ward off difficulties and provide useful information.

But how?

SumUp offers customer support via email, online help center, and live chat, which appears to have caused problems for some merchants.

Unlike its main competitors, though, SumUp maintains a direct customer support phone number during business hours.

Despite some cases of customers not being given a timely response in early 2013, the release of SumUp Air reader has solved these issues and the SumUp app has really improved its customer support.

The result?

In the last few years, their online customer support has received fewer complaints, than in previous years. There is also no available evidence of the company being a sham, and the only issues cited by customers are of the intricate protocols imposed by Visa card in Europe.

SumUp Online Help Center

Some customers also complain of the sluggish delivery of funds, however, no customer complained about payments not being received or fraudulent activity.

The instances were isolated and in general, customers online are thoroughly happy with the service.

Who will benefit the most from SumUp card readers?

While all businesses can benefit from SumUp card machine to some degree, it is the lone vendors and small businesses that derive the most benefits.

Both SumUp card readers will be a perfect solution for small businesses and sole traders requiring a portable, easy to use card processing device. However, for large-scale businesses, it might not be the best option.

Another group that can make use of this commodity is travellers or businessmen on the go who require fast money taken anytime and anywhere.

What’s the catch?

Apparently, not all businesses can be supported by SumUp. High-risk companies offering e.g. adult entertainment, door-to-door sales, cosmetic surgeries will need to seek special approval before using the SumUp card reader.

Does SumUp work abroad?

Yes, SumUp offers its service in 31 countries on three continents.

It is actually possible to temporarily set up your account to process in one of these other countries, which is ideal for businesses that travel to trade shows and other events.

It’s simple.

Once you contact the support center, they’ll enable you to process payments in the other countries where SumUp operates. At the moment that includes:

|

|

Quite impressive, right?

This is something that definitely sets SumUp apart from its main competitors. And that could actually be a dealbreaker.

SumUp Review Summary & Final Verdict

Despite a few small shortcomings, SumUp credit card readers are reliable and trustworthy tools to solve the problem of payments in today’s digital world, especially for small companies.

The set up is very easy to follow and the transactions are visible, with no apparent deceit discovered as of yet.

Moreover, SumUp devices are compatible with major credit and debit cards and can be used easily to print out receipts (SumUp Air) as well as keep track of purchases and sales.

So, does SumUp live up to our expectations?

Overall, yes.

| All things considered, our rating score for SumUp card readers is | 4.5 / 5 |

Using SumUp card readers is very intuitive. Once you start, the device is seamless to operate. They work similar to card machines offered by iZettle or MyPOS and you can track your purchases as well as save items for later.

What else?

All the transactions are easily accessible so you can keep track of them and you receive the money directly into your bank account within 2-3 working days.

The new SumUp 3G card reader presents an even more easy way of accepting payments anywhere, anytime. This card reader is efficient for simple sales, where paper receipts are not necessary.

In short, SumUp 3G card reader is suited for all business owners who desire a standalone device for accepting debit/credit cards, as well as contactless payments without any advanced features.

So it all adds up to this:

With the lowest transaction fee on the market and no monthly costs, both SumUp card readers prove to be convenient for low-volume merchants who just need to start accepting cards.

JUMP TO:

JUMP TO:

David - June 21, 2019 @ 10:30

Speaking as a taxi driver – Easier than I thought and handy when cash machines are not available or have no cash.

Tim Lnt - July 24, 2019 @ 12:55

I bought SumUp Air reader – it’s a good piece of equipment. I have my own business and this works perfectly.

CMT - July 26, 2019 @ 09:25

Response time could be quicker, but overall satisfied.

Rob Restaurant - February 19, 2020 @ 15:26

sometimes it could work faster, but compared to classic card readers, it is still much better (cheaper and easier to use)

Gigi - February 21, 2020 @ 09:29

Bluetooth connection between smartphone and card reader often doesn’t work which is super annoying. The transfer of the money takes forever.

random_millionaire - February 24, 2020 @ 12:57

The device is actually quite good. It’s not so big, the fees are not so high and you can use it with your mobile phone really easily. So I give a clear recommendation to buy.

The only problem for me is the contactless function – many times it simply didn’t work.

The device is actually quite good. It’s not so big, the fees are not so high and you can use it with your mobile phone really easily. So I give a clear recommendation to buy.

The only problem for me is the contactless function – many time