SumUp Credit Card Machine & App [Review 2018]

|

|

|

|

|

|

|

|

| 50% discount for SumUp card reader

|

Our Rating

-

SumUp card reader

Review Summary

SumUp credit card machine is a reliable and trustworthy tool to solve the problem of payments and money handling in today’s digital world, especially for small and medium based companies.

The set up is very easy to follow and the transactions are visible, with no apparent deceit discovered as of yet. It is compatible with major credit and debit cards and can be used easily to print out receipts as well as keep track of purchases and sales.

Last updated: 03/01/2019

Table of Contents

SumUp card reader: The hype is in the Air

Business has never been easier for young entrepreneurs and small business owners, with so many useful and handy gadgets on the market.

One of these tremendous innovations is latest Chip and PIN technology reader, SumUp, proving to be a reliable solution at an affordable price. The world has gone digital and most businesses run on e-commerce, having cash at hand in today’s society has become outmoded.

In such times, devices such as SumUp Air can make your life easier and more manageable. Due to a deficit of money at hand, retailers need to process extra cards and in a world where time is everything, having a top-notch solution to this problem can really revolutionize your life.

With an economical flat rate at 2.75%, this new mobile card reader presents you a preset rate without the hassle of additional costs.

SumUp card reader |

|

|---|---|

|

|

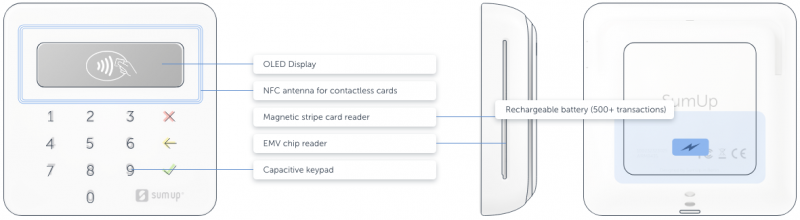

Chip & PIN reader | Yes |

Contactless (NFC) receiver | Yes |

Magnetic stripe reader | Yes |

Device charge via USB | Yes |

Device connection | Bluetooth to smartphone or tablet with Internet connection (WiFi, 3G, 4G) |

Supported printers | Two mobile Bluetooth printers and several network printers |

Prominent features

1. Long lasting battery

With a long lasting battery life, SumUp is very easy to carry on tours and travels, it does not run out easily and

2. Chargeable with Micro USB

It is easily chargeable with the Micro USB cable included in the package. Even while charging, you can use the card machine.

3. Pocket Size

It is a great travel gadget with a size of 7cm x 7cm x 2.5cm hence can easily fit into most briefcases or bags and does not increase luggage weight substantially. It can easily be used whenever required and stored away when not needed.

4. Easy and reliable transactions

It is compatible with most credit and debit cards (Visa, VPay, MasterCard, Maestro or American Express) and can easily be used when making transactions. Moreover, the card terminal comes without any monthly costs or contracts that could hinder your progress. The payment is guaranteed and reliable; the chances of theft are considerably low and your money is in secure hands.

Key Takeaway: The SumUp Air is a great portable device that business owners can take with them wherever they need to accept payments. It’s extended battery life and easy-of-use means that virtually anybody can process payments anytime they require.

SumUp payments – Costs & Fees

As stated before this device offers a very fluid and see through transaction process with a rate of 2,75 on all payments. An additional €39 has to be given by the mobile card reader as one time fees. If you no longer want to use the service, you can easily cancel it by contacting the company.

In compliance with the company’s cash reserve policy, some portions of payments are withheld to prevent fraudulent activity. This policy is not a major cause of concern and the upside is that there is absolutely no termination fee and no PCI compliance fee.

SumUp Costs & Fees in UK |

|

|---|---|

Price | 3̶9̶€̶ 19€ |

Transaction fee - debit/credit card | 2.75% |

Fixed monthly fee | 0€ |

Minimum revenue threshold requirement | 0€ |

Supported credit and debit cards | Visa, Visa Electron, V Pay, Mastercard, Maestro, American Express |

Settlement delay | 2-3 business days |

Receipts | Print, SMS or Email |

Tips | No |

Key Takeaway: SumUp makes payment processing affordable for businesses of any size, with a low initial investment and a per-transaction-fee that is much lower than standard credit card companies.

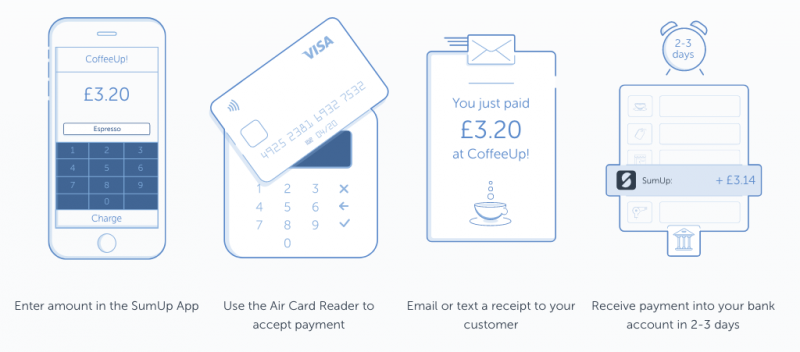

How to set it up

All the instructions that are required for a setup are available on the box and even when the SumUp application is downloaded. The set up is relatively simple, after downloading the app (which is free for Android and iOS), you connect the device and allow one pound into the app.

After initiating the charge the setup begins by design. However, if the instructions are vague on the box, then there are online guidelines that can help you set up the device more accurately.

All you need after that is an internet connection or good WiFi and you are good to go.

The wireless SumUp Air connects through the cloud-based server, analyzes, and proceeds with your transactions. In order to receive the card reader, you have to register online, which is fairly simple.

The card reader is delivered by post within a week and you can start using it right away.

How to use SumUp (step-by-step guide):

Key Takeaway: Setting up the SumUp app is very easy and can be done by those who have a low level of technical knowledge. You can have the terminal and app running together within minutes and will be ready to start accepting payments in no time!

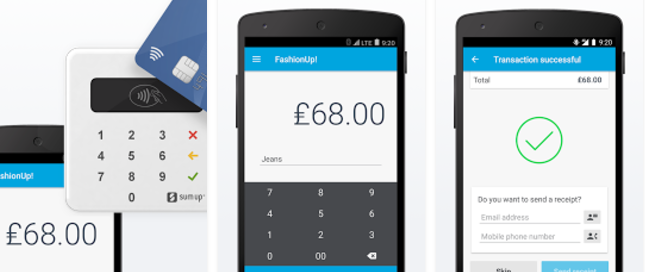

SumUp App

The SumUp app is available to download for free for either the Android or iOS platforms and take very little time or effort to set up.

Once you have downloaded the app and created your account, you can begin to add your New Products into the store.

Adding a new product is simple, as a screen opens where you can upload a picture, add a product name, description and set the tax rate for each item. You can also add a variety of versions for each product, such as the size, color or any other identifying information.

Once you have products in the app, you can create “Shelves”, which are essentially different categories for your products. This keeps your inventory well organized and is very beneficial if you are working in a busy environment, so that you can easily navigate to find items.

SumUp offers very intensive transaction history information, including:

- name of the sales agent

- the time/date

- merchant ID

- payee card number

- map (to identify location of transaction)

- the products sold

- tax information

You are also given the opportunity to print, email or text the receipts to the purchaser after each transaction. After the transaction is completed, the receipt option will pop up and you can select the method of your choice.

Key Takeaway: SumUp offers vendors a wide variety of services to help them sell their products, manage inventory and view past transactions. By making it so simple to add and organize products, businesses can have their entire product line uploaded into SumUp and ready for sale within a day.

SumUp App |

|

|---|---|

Mobile app | Free |

Smartphone or tablet operating system |  |

App Store | |

Google Play | |

Superb Customer service

Often time customers have a lot of questions that need answering and a good customer service is one that gives a timely and comprehensive response. This company also offers great customer service which interacts with customers to ward off difficulties and provide useful information.

Digital communication through the use of emails is ideal; however, a landline is also available for customers. Despite some cases of customers not being given a timely response in early 2013, the initiation of Air reader has solved these issues and the SumUp app has really improved its customer support.

In the last few years, their online customer support has received less than 10 complaints, which is commendable. There is also no available evidence of the company being a sham, and the only issues cited by customers are of the intricate protocols imposed by Visa card in Europe.

Some customers also complain of the sluggish delivery of funds, however, no customer complained about payments not being received or fraudulent activity.

The instances were isolated and in general, customers online are thoroughly happy with the service.

Key Takeaway: SumUp’s commitment to providing top class quality service gives businesses the peace of mind knowing that if there are any issues, they will be resolved quickly. Since the app is such a major part of many company’s payment processing, it is good to know that they can rely on SumUp to ensure a quality experience.

The target Audience

While all businesses can benefit from SumUp card machine to some degree, it is the lone vendors and small businesses that derive the most benefits. Companies that require credit or debit card readers and accountings are more likely to take advantage of this new gadget.

In fact, lower volume traders fare better than high volume ones. If your monthly sales are greater than £5,000, then your company will have to opt for contenders due to the high rate drawback.

SumUp is also great for nonprofit organizations such as NGOs, societies, clubs, academic institutions, however, for large-scale businesses it might not be the best option.

Another group that can make use of this commodity is travelers or businessmen on the go who require fast money or transactions and cannot travel with a lot of money. With a great customer service that operates even abroad, many tourists do take advantage of this device.

Key Takeaway: All businesses from startups to established vendors can use SumUp to easily process payments on the go. The attractive low cost per transaction and the portability means that it is perfect for those who sell goods on the go or in their retail shop.

Pros & Cons – SumUp Card Reader

Pros:

Pros:

Despite its novelty, it is becoming widespread, with cheap transaction rates and easy card reading options for customers. From traveling to societies, this device can prove advantageous to a number of groups.

It is available in most of Europe and is backed by big names such as BBVA Ventures, American Express, and Groupon. For small scale vendors, SumUp is a great option and is routinely employed by a number of such companies.

Its usage is expected to increase in the future, and with a commendable customer support behind its back, customer satisfaction can be predicted to increase in the coming times.

Cons:

Cons:

Despite its obvious benefits, there are some downsides to this device. Firstly, as claimed before large scale companies can fend better with competitors especially the ones that make great transactions on a monthly basis.

Moreover, the phone support is limited to working hours between 9 am to 6 pm and any business activity after this time will not be able to make use of the gadget. This is a downside for travelers as the need for payment can arise at any given time.

There are also some customers who complain about the setup, claiming that the online instructions are vague, while some claim that the external devices such as printers are hard to connect.

However, these customer complaints are isolated cases and not the majority opinion, hence it can be concluded that overall, SumUp is a good option for small and medium scale enterprises (SME’s).

Summary & Final verdict

All things considered, our rating score for SumUp is 4.2

Once you learn how to use it, the application and the device and seamless to operate. They work similar to applications such as iZettle and payleven’s and you can track your purchases as well as save items for later.

All the transactions are easily accessible so you can keep track of them and if a customer has made a payment through it, you receive the money directly into your bank account within a few working days.

It also supports 2 mini wireless printers which can come in handy when you want to print receipts for customers, these however can also be delivered online.

To make the payment, you first dial the amount the customer has to pay for the application, show it to the customer who hands you the credit card to fit into the gadget.

The customer then puts in their PIN code and the transaction is approved. All of this is done transparently and reliably in front of the customer. After the transaction is made an email is sent to the customer, including the amount details and the item purchased.

A number of cards are accepted by SumUp including Visa, Visa Electron, V PAY, Maestro, MasterCard, American Express.

With the SumUp Air card reader you can also accept contactless card payments via NFC (Near Field Communication) technology.

Usually, payments are credited within 2-3 business days but with the flow of business, this is a very small downside compared the obvious benefits.

50% discount for SumUp card reader

This SumUp video presents how to accept card payments with PIN+ terminal (That’s SumUp Air predecessor):

If you are not sure…